Bohemia TRADE INVEST AS

Smart Capital. Smooth Logistics. Secure Payments.

Trade Finance Consulting Services

We provide professional consulting services in trade finance, supporting companies engaged in international trade transactions.

Our advisory services help businesses structure payment terms, manage financial risks, and improve cash flow in cross-border trade operations.

We work with trading companies, exporters, importers, and distributors operating across international markets.

Our trade finance consulting services focus on the practical structuring and management of trade-related financial instruments and processes.

Trade Finance Structuring

We advise companies on structuring trade finance solutions, including:

- Working capital optimization for trade operations

- Structuring payment terms with suppliers and customers

- Alignment of trade finance with commercial contract

Letters of Credit & Documentary Instruments

We provide advisory support related to trade finance instruments, including:

- Letters of Credit (LC)

- Standby Letters of Credit (SBLC)

- Documentary Collections (D/P, D/A)

- Coordination with banks and financial institutions

Risk Mitigation & Payment Security

We help companies manage financial risks in international trade, including:

- Counterparty risk assessment

- Payment risk mitigation

- Currency and settlement considerations

- Structuring secure payment flows

Bank Guarantees & Trade-Related Instruments

We advise on the use of trade-related financial instruments, including:

- Bank guarantees

- Performance and payment guarantees

- Risk allocation between trading parties

Trade Finance Process Optimization

We support companies in improving trade finance efficiency, including:

- Documentation alignment with bank requirements

- Reduction of processing delays

- Improvement of cash flow cycles

- Coordination between commercial, logistics, and finance teams

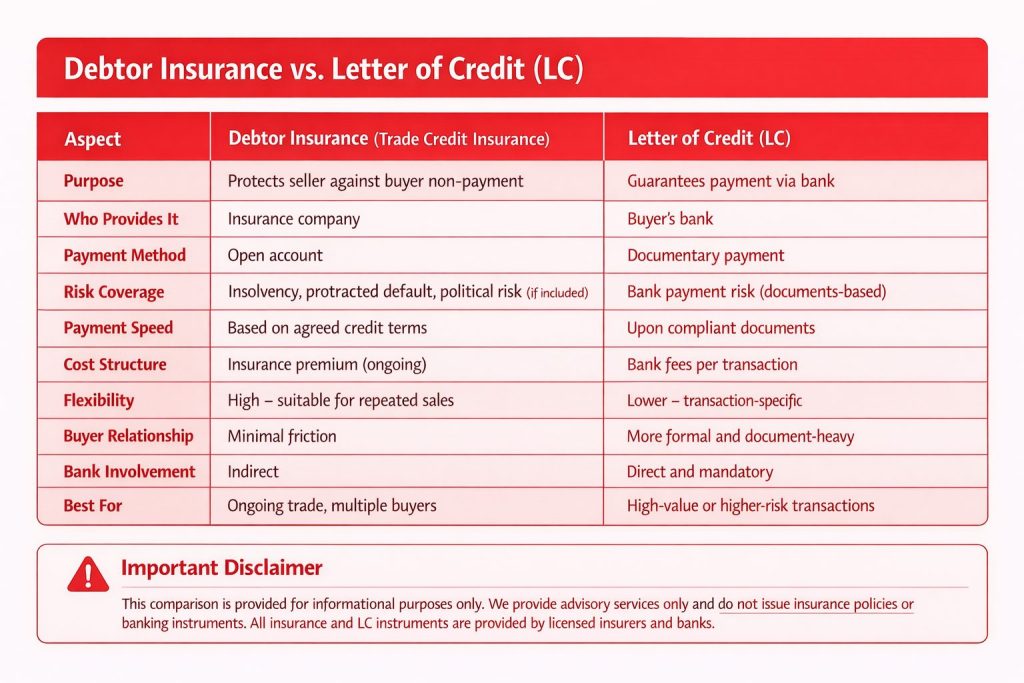

Debtor Insurance (Trade Credit Insurance)

Debtor insurance, also known as trade credit insurance, protects companies against the risk of non-payment by buyers in domestic and international trade transactions.

When to Use Debtor Insurance

- Regular or repeat buyers

- Open-account trading

- Multiple customers or markets

- Long-term commercial relationships

- Improving balance sheet stability

When to Use a Letter of Credit

- New or unknown buyers

- High-value transactions

- Higher-risk countries

- One-off or infrequent shipments

- When banks require documentary security

Combined Use (Best Practice)

- LC for new or higher-risk buyers

- Debtor Insurance for recurring trade and portfolio protection

This approach balances security, flexibility, and cost efficiency.

Trade Credit (Debtor) Insurance Providers – Regional Overview

We work on an advisory basis with companies using trade credit insurance solutions provided by leading international insurers. Here is a regional overview of major providers active in debtor (trade credit) insurance.

Europe (EU & UK)

- Allianz Trade

European market leader with global reach; strong presence across the EU and extensive exporter portfolios. - Atradius

Headquartered in the Netherlands; widely used by EU exporters and multinational trading companies. - Coface

France-based insurer with strong EU coverage and advanced political risk expertise. - Credendo

European-focused provider specializing in commercial and political risk insurance. - Zurich Insurance Group

Swiss-based global insurer offering integrated credit and financial risk solutions.

Asia & Asia-Pacific

- Allianz Trade

Strong footprint in China, Southeast Asia, and major Asian trade hubs. - Coface

Active across Asia-Pacific, supporting exporters and cross-border trade into and out of Asia. - QBE Insurance Group

Australian-based insurer with strong presence in Asia-Pacific markets. - AIG Trade Credit

Provides trade credit insurance solutions across Asia through multinational programs. - Regional Export Credit Agencies (ECAs)

Government-backed insurers supporting exports in selected Asian countries.

Americas (North & South America)

- AIG Trade Credit

Strong presence in the United States and Latin America, widely used by exporters and distributors. - Allianz Trade

Active across North and South America, supporting multinational trade portfolios. - Chubb

US-based insurer offering trade credit and specialty risk solutions. - Coface

Supports exporters and trading companies across the Americas. - Export Credit Agencies (ECAs)

Government-backed providers supporting export transactions in the US and Latin America.

CHINA

- SINOSURE (China Export & Credit Insurance Corporation)

The primary state-owned export credit insurer in China.

International Insurers Active in China

- Allianz Trade

Provides trade credit insurance for multinational companies operating in or trading with China. - Coface

Active in China, supporting exporters and importers with buyer risk assessment and credit insurance. - Atradius

Offers trade credit insurance through multinational programs covering Chinese buyers. - AIG Trade Credit

Provides structured trade credit insurance solutions for international trade involving China.

Contact US

If you require professional consulting support in international trade finance and international trade insurance, please contact us to discuss your needs.